Stop Wasting Money on High-Cost MCAs: 5 Quick Debt Consolidation Hacks

If your business is stuck in the merchant cash advance (MCA) debt cycle, you're not alone. Thousands of business owners across New Jersey and beyond are paying astronomical fees: sometimes 50% to 100% APR or higher: just to keep their doors open. The worst part? Many don't realize there are proven ways to break free from this expensive trap.

MCAs might seem like quick fixes when cash flow gets tight, but they're designed to keep you coming back for more. The daily or weekly payments eat into your revenue, making it harder to build working capital or invest in growth. Before you know it, you're stacking one MCA on top of another, creating a debt spiral that's nearly impossible to escape.

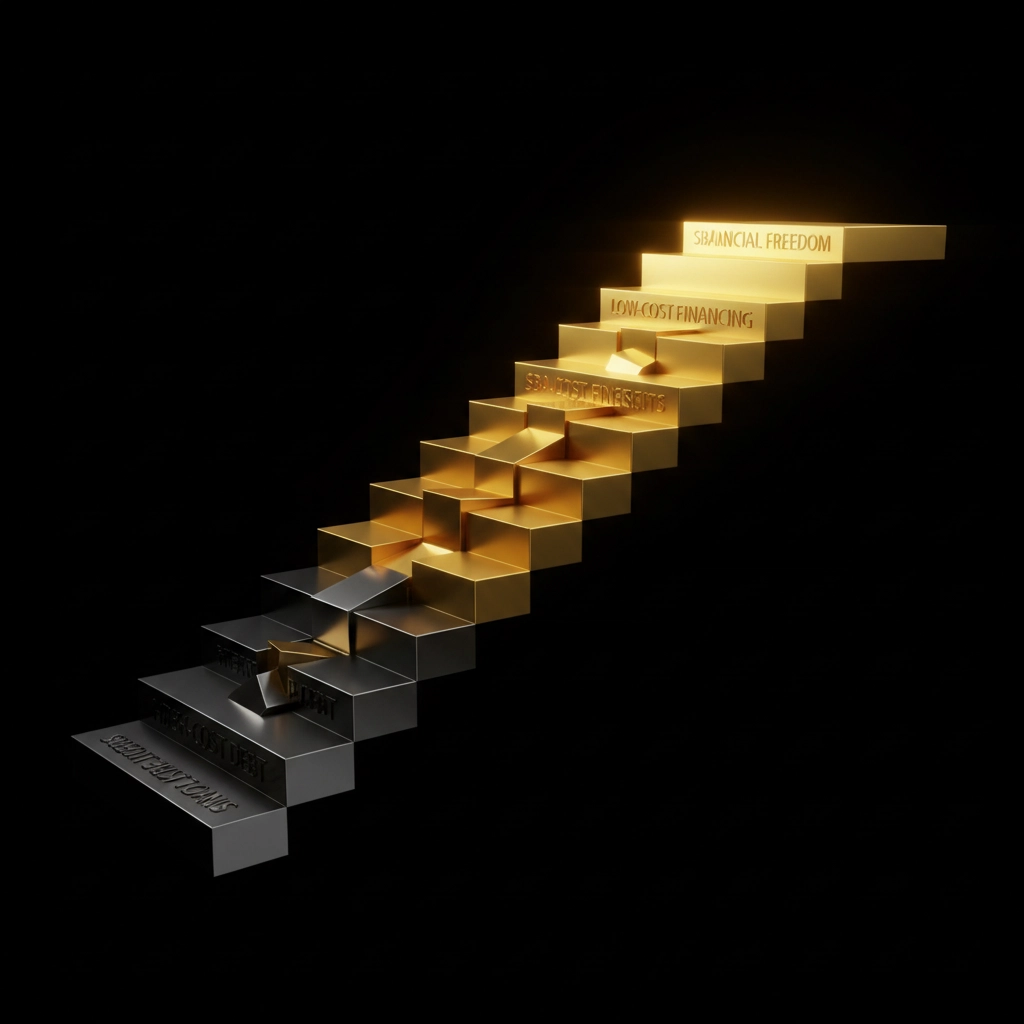

Here's the good news: smart business owners are using these five debt consolidation strategies to ditch high-cost MCAs for good and regain control of their finances.

Hack #1: Strategic Business Loan Consolidation

The most direct path out of MCA debt is consolidating multiple advances into a single, lower-cost business loan. Instead of juggling 3-4 different MCA payments with varying terms, you get one predictable monthly payment at a fraction of the cost.

How it works:

- Apply for a business consolidation loan that covers your total MCA debt

- Use the loan proceeds to pay off all existing MCAs immediately

- Make one fixed monthly payment instead of daily MCA deductions

Real example: A New Jersey restaurant owner was paying $2,400 weekly across three MCAs (effective rate: 87% APR). After consolidating with a traditional business loan at 12% APR, their monthly payment dropped to $1,850: saving over $3,000 monthly.

Best candidates: Businesses with at least 12 months in operation, $250K+ annual revenue, and credit scores above 550. Your business needs sufficient cash flow to support traditional loan payments rather than daily deductions.

Hack #2: Equipment Financing Refinance Strategy

If your business has valuable equipment, vehicles, or machinery, you can leverage these assets to eliminate MCA debt through equipment refinancing.

The process:

- Asset evaluation: List all business equipment with current market value

- Refinance application: Apply for equipment financing using your assets as collateral

- MCA payoff: Use refinancing proceeds to eliminate high-cost advances

- Lower payments: Enjoy reduced monthly payments with the equipment as security

Equipment financing typically offers rates between 8-20% APR: dramatically lower than MCA costs. Plus, you keep using your equipment while paying it off.

Pro tip: Even if you own equipment outright, you can still get equipment financing against it to fund MCA elimination. The lower interest rates make this strategy highly effective for manufacturing, construction, and transportation businesses.

Hack #3: Invoice Factoring Flip

For businesses with strong B2B customer bases, invoice factoring can provide immediate cash to eliminate MCA debt while creating a healthier cash flow pattern.

Here's the strategy breakdown:

- Factor your receivables: Sell outstanding invoices to a factoring company for immediate cash (typically 70-90% of invoice value)

- Pay off MCAs: Use factoring proceeds to eliminate all existing merchant cash advances

- Improve cash flow: Factoring provides predictable cash without daily deductions

Key advantages over MCAs:

- No daily or weekly payments disrupting cash flow

- Rates typically 1-3% per month (much lower than MCA costs)

- You can scale factoring up or down based on business needs

- No personal guarantees required in most cases

Best for: B2B companies with customers who pay within 30-90 days, including service providers, manufacturers, and distributors.

Hack #4: Revenue-Based Financing Restructure

Revenue-based financing (RBF) offers a middle ground between traditional loans and MCAs, but with much better terms than typical advances.

How RBF beats MCAs:

- Lower cost: Typically 6-20% of monthly revenue vs. 10-30% for MCAs

- Flexible payments: Payments adjust based on actual revenue performance

- Faster payoff: Most RBF agreements include caps that limit total repayment

- Growth-friendly: Lower payment percentages leave more cash for business operations

Implementation strategy:

- Research reputable RBF providers (avoid MCA companies offering "revenue-based" products)

- Apply with 12-24 months of bank statements and revenue documentation

- Use RBF proceeds to eliminate existing MCAs

- Benefit from lower monthly payment percentages and capped repayment terms

Warning: Make sure you're working with true revenue-based financing, not rebranded MCAs. Legitimate RBF providers offer transparent pricing and reasonable payment terms.

Hack #5: SBA Loan Debt Consolidation

SBA loans represent the gold standard for business debt consolidation, offering the lowest rates and longest terms available to small businesses.

SBA consolidation benefits:

- Ultra-low rates: Currently 11.5-14.5% for most SBA loan programs

- Long terms: Up to 25 years for real estate, 10 years for equipment, 7 years for working capital

- Lower payments: Extended terms mean dramatically reduced monthly obligations

- No prepayment penalties: Pay off early without additional fees

The SBA consolidation process:

- Document your debts: Gather all MCA agreements and payment records

- Find an SBA preferred lender: Work with banks experienced in debt consolidation

- Prepare financials: Provide 3 years of tax returns, current financial statements, and cash flow projections

- Submit application: Allow 30-60 days for underwriting and approval

- Close and consolidate: Use SBA loan proceeds to eliminate all MCAs

Reality check: SBA loans require strong credit (typically 650+), solid cash flow, and extensive documentation. The approval process takes longer than other options, but the savings are substantial for qualifying businesses.

Breaking Free: Your Next Steps

The key to successful MCA elimination is acting quickly before debt service consumes too much of your cash flow. Each day you wait, more revenue goes toward fees instead of business growth.

Start with these immediate actions:

- Calculate your total MCA costs: Add up all daily/weekly payments and multiply by payment frequency to see your true monthly debt service

- Gather financial documents: Prepare bank statements, tax returns, and current financial statements

- Research consolidation options: Compare the five strategies above based on your business profile and qualifications

- Apply strategically: Focus on the option with the highest approval probability and best terms for your situation

Get Professional Help

Navigating debt consolidation while running your business is challenging. Chrome Haris Capital specializes in helping businesses escape expensive MCA cycles through strategic funding solutions tailored to your specific situation.

Our team understands the urgency of MCA debt and works quickly to identify the best consolidation path for your business. Whether you need traditional business loans, alternative financing, or credit repair services to qualify for better terms, we're here to help.

Don't let high-cost MCAs drain your business's potential. Contact Chrome Haris Capital today to explore your debt consolidation options and take the first step toward financial freedom.

Your business deserves better than the MCA debt trap. With the right strategy and professional guidance, you can eliminate expensive advances and redirect that money toward growth, inventory, marketing, or building the cash reserves that prevent future cash flow crises.

The sooner you act, the sooner you'll stop wasting money on high-cost debt and start building the profitable, sustainable business you've always envisioned.

#DebtConsolidation #MerchantCashAdvance #BusinessFunding #SmallBusiness #BusinessLoans #WorkingCapital #CashFlow #BusinessDebt #NewJerseyBusiness #SBALoans #BusinessFinancing #MCADebt #ChromeHarisCapital #BusinessSolutions #FinancialFreedom #MCADebtRelief #DebtRestructuring #ReverseConsolidation #InvoiceFactoring #EquipmentFinancing #RevenueBasedFinancing #LinesOfCredit #TermLoans #BridgeLoans #CreditRepair #DirectFunder #FastFunding #LowRates #SmallBusinessFunding #CashFlowManagement #NJBusiness #NewJersey #SBA7a #SBA504